The Big 3 Factor: How Helpful Are Big VC Names In Raising Future Capital Rounds?

June 8, 2021

To Follow-on Or Not To Follow-on?

The logic is simple. Once a VC makes an investment, she will want to protect that investment as much as possible. Protecting the investment consists of mainly two things: (1) growing the value of that investment; and (2) keeping the ownership stake as close as possible to its original level.

In this sense, a follow-on investment is a way to protect the percentage of ownership a VC has in a company, which is one of the two ways of protecting their investment. Needless to say, a VC will want to maintain the original (or more) ownership stake in companies that they expect to be worth more in the future.

But it gets tricky. If a VC doesn’t follow-on, will it signal other investors that the investment opportunity is no longer attractive? Moreover, will this non follow-on signal adversely impact the terms and valuation the startup gets in the subsequent financing round? If so, the VC will want to do a follow-on just to protect the value of its original investment.

In general, there are three good reasons as to why a VC wouldn’t do a follow-on round. These reasons won’t signal to other investors that the investment opportunity is not good. The reasons are:

- The VC only invests in specific stages: It could be the case that the VC only invests in Seed or Series A startups, and therefore investing in a Series B or Series C wouldn’t be suitable for their investment thesis.

- It’s a small round: There are only a few spaces opened for new investors and the VC will allow others to join the party.

- Too much money: The next round average investment ticket is too big for the VC and so they won’t be able to participate.

When a startup raises a subsequent investment round, the VC’s original stake usually drops. One way to avoid this is by having pro rata investment rights. Pro rata investment rights (preemptive right term) give the VC the option to deploy additional capital to the startup they’ve invested in, in order to maintain its initial ownership stake. With these investment rights the VC can ensure a place in a subsequent investment round, should this event take place.

Fear of Missing Out (FOMO) is also a major contributing factor when a VC is deciding whether to follow on or not.

A follow-on can therefore be broken into two scenarios:

- a) The startup’s situation is not favorable, but the VC follows-on as a way of signaling that the investment is still good (and with the expectation that the startup will correct its course.)

- b) The startup’s situation is favorable and the VC invests to keep cashing in the startup’s success.

Invest Before Product-market Fit, Double Down After

As mentioned earlier, follow-on investments are important ways that allow the value of a company to grow, and hence, the value of the investment made by a VC. In the past years there has been a tendency of VC funds starting funds that are exclusive for follow-ons. Fred Wilson’s Union Square Ventures was one of the pioneers in doing this, by launching in 2011 their so-called Opportunity Fund (USD 135 million) — a fund meant to exclusively invest in follow-ons, and, more specifically, startups that have achieved their most ambitious milestones.

Since 2011, many other recognized VCs have launched their own version of Union Square Ventures’ Opportunity Fund. Some names include The Foundry Group (USD 225 million), Greycroft Partners (USD 200 million), Y Combinator (USD 700 million), and DFJ¹. Everybody wants to invest in the best startups, but as Backus from New Atlantic Ventures says: “Those who pioneered opportunity funds recognize that, while everyone competes to invest in the best companies, there is a better way to get access to these very best companies — and that is to already be an existing investor.”

In a study, Stevenson H. found that VC funds usually are able to get the best returns when they continue to invest their pro rata share in each investment round, as compared to VC funds that don’t make follow-ons.

Syndication Has Power Too

A VC syndicate is a group of VC funds that invest together in one or more startups. When VCs invest in syndicates, they share both their expertise and risk. This allows them to increase the likeliness of their investments to be successful. But, what is the effect of a startup receiving funding from a VC syndicate? Will it help the startup secure future rounds of funding and future favorable investment terms?

Walske et al demonstrated that VC funds with strong ties between themselves can predict strong success for a startup that received funding from them. (2007) In other words, syndication from VCs tends to bring lots of positive outcomes for startups — i.e. closing future funding rounds with more favorable terms.

In their study, Walske et al also found that, whether a VC syndicate is composed only of elite VC firms or not, it doesn’t have an impact on the startup’s future success. They did find that the ideal VC syndicate, which maximizes the startup’s future success, is one that is composed of elite VC firms that work well together.

There are advantages for both strong and weak ties between VC syndicates. The advantages for weak ties include the spread of knowledge and increased negotiating leverage. On the other hand, strong ties allow for the deeper exchange of information and a more productive relationship when information is less clear. (Uzzi, 1997)

Elite VC firms are often the minority within the syndicate, however, their influence remains large, as they more consistently invest across rounds. (Welske et al, 2007) VC syndicates can last for a decade (which, by the way, is longer than the average American marriage), that is why the quality of the relationship between VCs matters most in determining a startup’s future success.

Welske et al also found that when a startup has to choose between a VC syndicate that is prestigious and one that has a history of having a good relationship between the VCs, the startup should choose the one that has a good relationship history in order to maximize its chances of success — as closing future rounds with favorable terms.

Syndication can be costlier to experienced VC firms. They usually are better at identifying the best prospects, so when a syndicate is created, the participants need to let a piece of the pie go. Hopp and Rieder found that more experienced German venture capitalists syndicate much less than inexperienced ones. (2006)

Kaplan and Stromberg found that the degree of valuable advice and activities a VC provides to a startup is directly related to the equity stake that the VC has in that startup. Also, they found an inverse relationship between the size of the VC syndicate and the valuable advice and activities that the syndicate provides to the startup they invest in. (2004).

In Unity Lies The Strength

The extent to which there are strong cooperation networks of VC firms within an entrepreneurial ecosystem, determines the degree of development of that ecosystem.

In his research, Castilla found that the particular structure of the VC firms network in Silicon Valley is what allowed for a higher growth and development of that region, as compared to many other regions worldwide. This higher growth and development refers to a good extent to the successful development and scalability of startups in the region, made possible by the successful raising of capital rounds.

Sequoia, Accel and A16Z are all located in Silicon Valley. This place is known for having the unique network structure to foster the creation and acceleration of technology startups. Unique because it is the key differentiator between Silicon Valley and the other entrepreneurial regions in the world. In his study, Castilla ran a network model comparing the entrepreneurial regions of Silicon Valley and Route 128 (Massachusetts) his findings showed the following:

Both Silicon Valley and Route 128 appear to have comparable concentrations of skills, technology, companies and other social institutions. However, in Silicon Valley, the entrepreneurial efforts and venture capital activities happen to be more embedded in densely connected networks. (Castilla, 2005)

These findings statistically explain the difference in development (startup success included) in Silicon Valley vs other regions worldwide.

Castilla’s research found out that the most prominent VC firms in Silicon Valley, Accel and Sequoia included, are the ones that have more connections with other VC firms. Performing statistical analysis and network modeling, he was able to conclude that this abundance of connections between VC firms is what allows the Silicon Valley ecosystem to thrive, as compared to other regions with similar characteristics.

The degree to which VC firms in a certain entrepreneurial ecosystem invest in startups from that same ecosystem is also relevant in determining the region’s entrepreneurial development. Castilla was able to pinpoint statistically significant differences between the investment choices of Silicon Valley and Route 128 (Massachusetts). He found that 70 percent of all investee companies for VC firms in Silicon Valley are located in California and only 30 percent are located somewhere else in the USA. On the other hand, only 42 percent of the investment of VC firms in Route 128 stays in Massachusetts. (Castilla, 130)

Moreover, VC firms in Silicon Valley spend a whopping USD 1.5 million more on average in their investments in startups than Route 128. This difference in average tickets also has an impact on a startup's success.

Finally, Castilla found out that, in Silicon Valley, 70 percent of all VCs cooperate with other VCs in the funding of companies, as compared to only 50 percent of VCs in Route 128.

In this sense, a great part of a startup's success is not determined by its ability to get investment from elite VC firms, but by it’s mere geographical presence.

Both Silicon Valley and Route 128 have comparable concentrations of skills and technology and even similar numbers of companies and institutions. However, important network differences emerge when examining the venture capital sector only — the most critical source of capital for many startup companies since the 1950s. (Castilla, 131)

Embeddedness in social networks shapes and facilitates the allocation of resources, support and information necessary for the development of new local organizations and the development and success of the region in the long run. Social networks matter because trust, information, action, cooperation: all operate through social relations. (Castilla,131)

VCs make ... all the difference?!

It turns out that the mere presence of VC firms can make all the difference within an innovation ecosystem. VC firms provide robustness to Silicon Valley. They depend on the other agents and vice versa. The presence of venture capital firms in an innovative cluster opens potential specific interactions with other agents in the network (universities, large companies, laboratories) that determine a particular dynamic of innovation. (Ferrary and Granovetter, 2009)

The existence of venture capital firms in an innovation hub is paramount. Ferrary and Granovetter found out that VC firms make five key contributions to Silicon Valley:

- Financing: Provide the capital necessary for startups to grow and scale.

- Selection: Careful consideration of the best projects via extensive research and due

- diligence.

- Collective learning: Resources, know-how, and experts in a clusterized space.

- Embedding: VC firms allow universities, companies, and research institutes to work

- with them. They aggregate the different innovation agents.

- Signalling: After financing them and working with them for a certain time, VCs signal

- the best startups to the business community so they can work with them too.

- The value doesn’t come from the activity of one sole agent. Rather, it comes from the interactions between the different agents (universities, companies, research institutes, and VC firms). Moreover, the successful outcome of an innovation hub like Silicon Valley comes from the key activities VC firms do, namely: financing, selection, collective learning, embedding, and signalling.

- A notable failure case of trying to create a successful innovation hub without VC firms can be seen in France in 2006. The French government launched an innovation initiative by launching sixty seven innovation hubs. These innovation hubs were composed of universities, research laboratories, and large technology companies. However, the policymaker didin’t include any VC firms. Back then, 95 percent of the VC firms were in Paris, while 85 percent of the innovation hubs launched outside of Paris. Long story short, it didn’t work.

- So yes. A main driver for a startup’s success is merely having VC firms around it.

Location Location Location

A startup’s location is paramount in its ability of raising capital. Many VC firms exhibit local bias, which means that they prefer to invest in startups that are geographically close to them, rather than startups that are far away.

By performing multivariate regression analysis, Cumming and Dai found that more reputable VCs (older, larger, more experienced, and with stronger IPO track record) and VCs with broader networks exhibit less local bias. This makes sense: their experience allows them to have a better sight for investment opportunities that are not geographically close.

On the other side, they found that staging² and specialization in technology industries increase VCs’ local bias, and that a VC exhibits stronger local bias when it acts as the lead VC and when it is investing alone. More specifically, they found that 50% of the investments of a VC are located within a 233 mile range from them. Finally, they found that distance matters for the eventual performance of VC investments.

This seems to suggest that startups that are close to the right VCs will have a better performance and chances of raising future rounds of capital.

Results

We wanted to know if receiving an investment by any of the so-called Big 3 firms in Silicon Valley (Accel, Sequoia, and A16Z) had an impact on a startup’s ability of raising future rounds. We gathered data on the most recent investments made by these 3 firms and the results were the following:

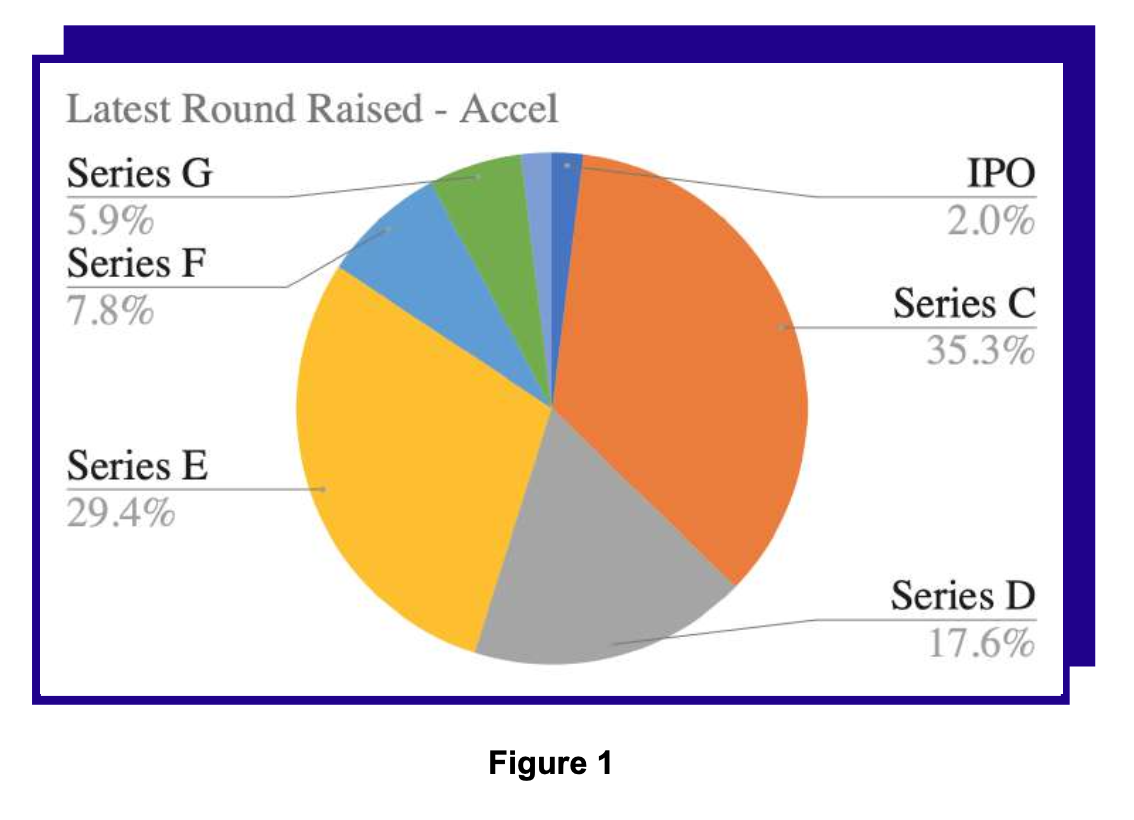

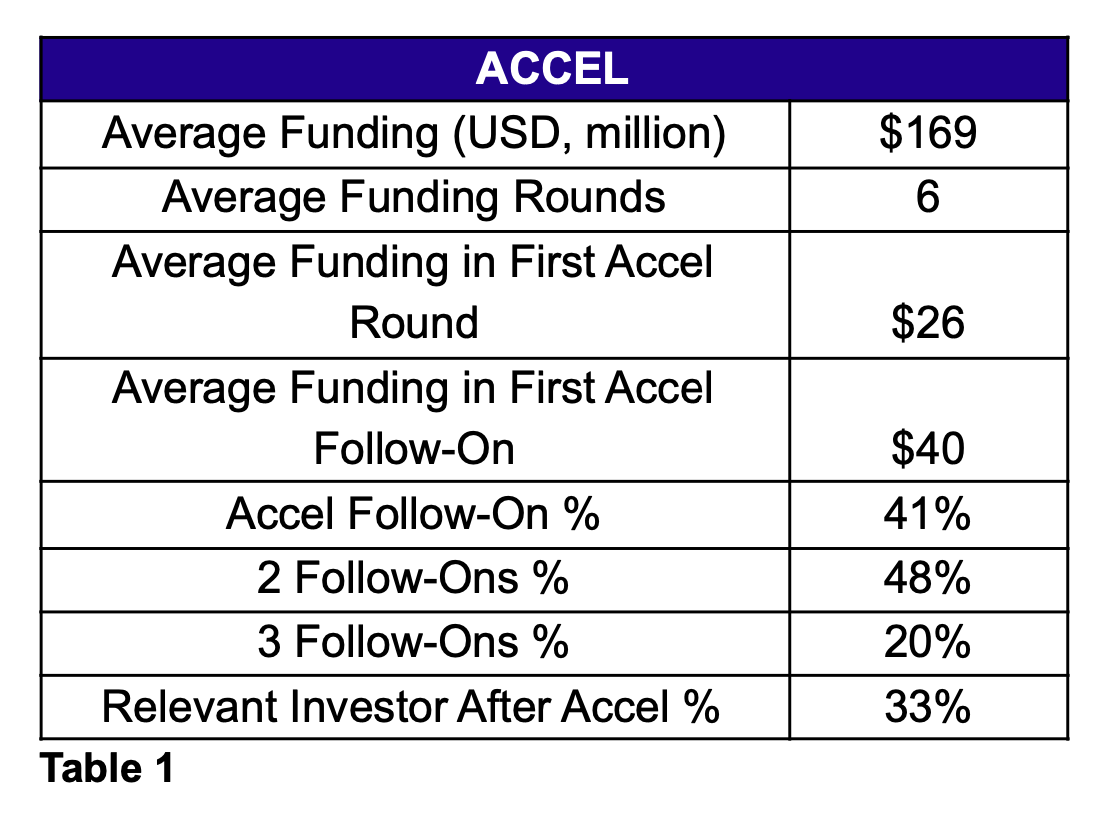

For Accel Partners:

- The latest round raised by startups that Accel invested in are late rounds ranging from Series D to IPO. This seems to suggest that an investment made by Accel improves a startup’s chance of raising future rounds. See Figure 1 for more detail

- The aforementioned point can be further proven by looking at Figure 2, which shows that the majority of Accel’s investments were made in early rounds ranging from Seed to Series C. This supports the hypothesis that an investment made by Accel in an early round further increases the chances of raising a future round.

- Table 1 shows the average path that a startup that receives funding from Accel follows.

- On average, all the startups that receive funding from Accel end up raising more capital in future rounds. Almost half of the startups that receive funding from Accel receive a second and a third follow-on round from Accel, and 1 in 5 receive a third follow-on.

- On average, 1 in 3 of the startups that receive funding from Accel also receive funding from another relevant³ VC firm in a future round.

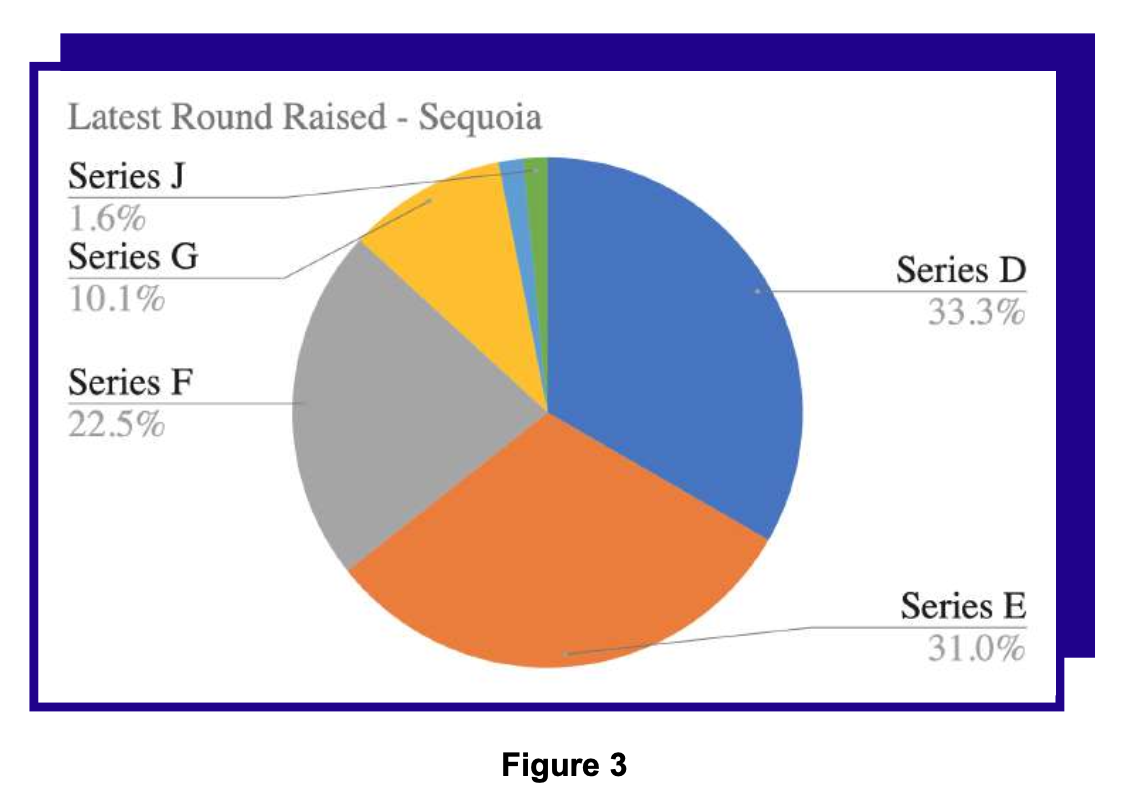

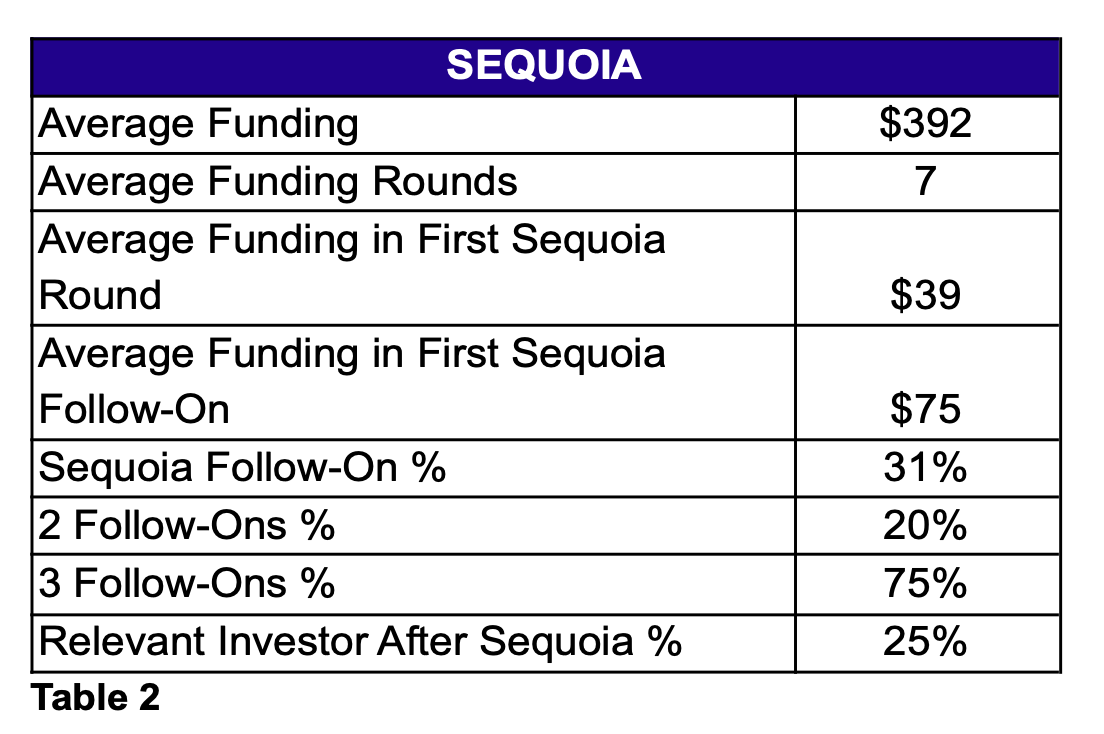

For Sequoia:

- The latest round raised by startups that Sequoia invested in are late rounds ranging from Series D to Series J. This seems to suggest that an investment made by Sequoia improves a startup’s chance of raising future rounds. See Figure 3 for more detail

- The aforementioned point can be further proven by looking at Figure 4, which shows that the majority of Sequoia’s investments were made in early rounds ranging from Seed to Series C. This supports the hypothesis that an investment made by Sequoia in an early round further increases the chances of raising a future round.

- Table 2 shows the average path that a startup that receives funding from Sequoia follows.

- On average, all the startups that receive funding from Sequoia end up raising more capital in future rounds. A third of the startups that receive funding from Sequoia receive a second follow-on, and 1 in 5 receive a third follow-on round from Sequoia, and 3 in 4 receive a third follow-on. This suggests that Sequoia doubles down heavily from the second follow-on onwards.

- On average, 1 in 4 of the startups that receive funding from Sequoia also receive funding from another relevant⁴ VC firm in a future round.

For A16Z:

- The latest round raised by startups that A16Z invested in are late rounds ranging from Series C to Series G. This seems to suggest that an investment made by A16Z improves a startup’s chance of raising future rounds. See Figure 5 for more detail

- The aforementioned point can be further proven by looking at Figure 6, which shows that the majority of A16Z’s investments were made in early rounds ranging from Seed to Series C. This supports the hypothesis that an investment made by A16Z in an early round further increases the chances of raising a future round.

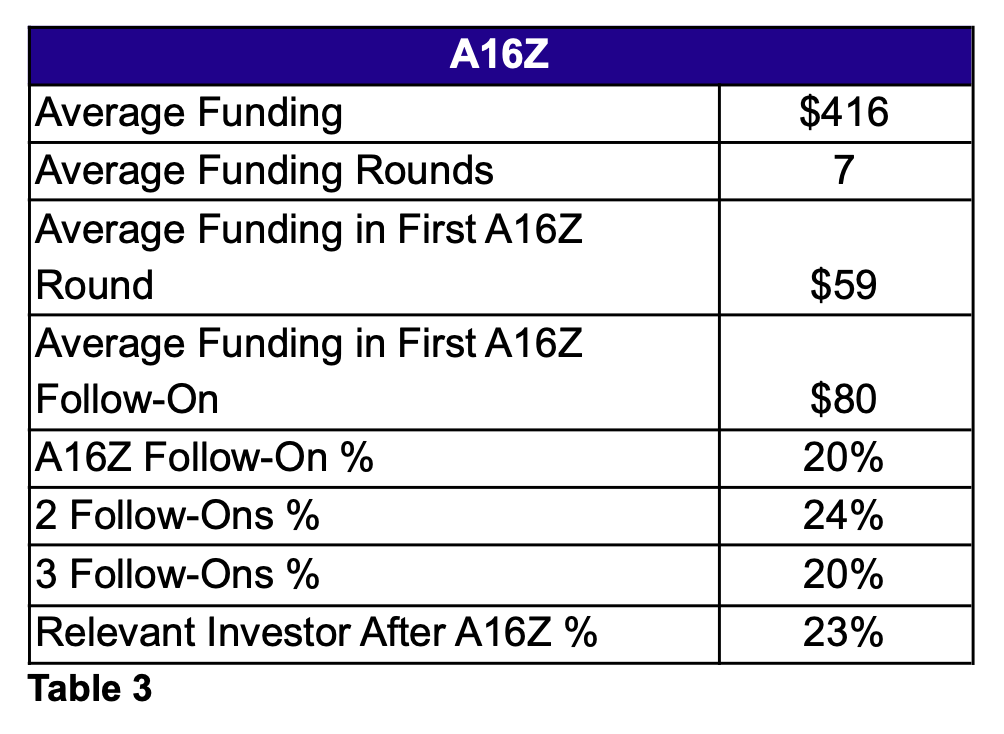

- Table 3 shows the average path that a startup that receives funding from A16Z follows.

- On average, all the startups that receive funding from A16Z end up raising more capital in future rounds. 1 in 5 of the startups that receive funding from A16Z receive a second follow-on, and 1 in 4 receive a third follow-on round from A16Z, and 1 in 5 receive a third follow-on.

- On average, 1 in 5 of the startups that receive funding from A16Z also receive funding from another relevant⁵ VC firm in a future round.

For Accel, Sequoia, and A16Z (The Big 3):

- Our analysis suggests that on average, receiving investment from any of The Big 3 ensures that any future round will have a bigger investment ticket.

- Our analysis suggests that, on average, The Big 3 do follow on investments one third of the time.

- Our analysis suggests that, on average, one fourth of the startups that received investment from any of the Big 3 will receive investment from another relevant VC firm.

Conclusion

- In the past years there has been a tendency of VC firms starting funds that are exclusive for follow-ons. VC funds usually are able to get the best returns when they continue to invest their pro rata share in each investment round, as compared to VC funds that don’t make follow-ons. So yes, a big name of a VC firm helps in raising future rounds at favorable terms, but that’s not the whole story. There’s a number of factors that influence whether a startup will raise future rounds or not. They include:

- VC funds with strong ties between themselves can predict strong success for a startup that received funding from them.

- The ideal VC syndicate, which maximizes the startup’s future success, is one that is composed of elite VC firms that work well together.

- Elite VC firms influence remains large, as they more consistently invest across rounds.

- The degree of valuable advice and activities a VC provides to a startup is directly related to the equity stake that the VC has in that startup.

- There’s an inverse relationship between the size of the VC syndicate and the valuable advice and activities that the syndicate provides to the startup they invest in.

- The extent to which there are strong cooperation networks of VC firms within an

- entrepreneurial ecosystem, determines the degree of development of that

- ecosystem.

- The abundance of connections between VC firms is what allows the Silicon Valley

- ecosystem to thrive, as compared to other regions with similar characteristics.

- A great part of a startup's success is not determined by its ability to get investment fromeliteVCfirms,but byit’smeregeographicalpresence,whichwillallowthemto

- have better counsel from VC’s and raise higher average tickets.

- The successful outcome of an innovation hub like Silicon Valley comes from the key activities VC firms do, namely: financing, selection, collective learning, embedding,

- and signalling.

- Distance matters. Startups will tend to perform better if they are close to their VCs.

Works Cited

Cumming D. and Dai N. (2008) Local Bias in Venture Capital Investments.

Ferrary M. and Granovetter M., The Role of Venture Capital Firms in Silicon Valley’s Complex Innovation Network. Economy and Society, 2009, vol. 38, no. 2, p. 326-359

Experience, screening, and syndication in venture capital investments (Catherine Casamatta C. and Haritchabalet C., 2007, Experience, screening and syndication in venture capital investments, Université de Toulouse)

Hopp, Christian, and Finn Rieder, 2006, What drives venture capital syndication?, mimeo University of Konstanz.

Kaplan, Steven, and Per Stromberg, 2004, Characteristics, contracts, and actions: Evidence from venture capitalist analyses, Journal of Finance 59, 2177-2210.

Castilla, E.J. (2003) ‘Networks of venture capital firms in Silicon Valley’, Int. J. Technology Management, Vol. 25, Nos. 1/2, pp.113-135.

Walske, Jennifer M.; Zacharakis, Andrew; and Smith-Doerr, Laurel (2007) "EFFECTS OF VENTURE CAPITAL SYNDICATION NETWORKS ON ENTREPRENEURIAL SUCCESS," Frontiers of Entrepreneurship Research: Vol. 27: Iss. 3, Article 2. Available at: http://digitalknowledge.babson.edu/fer/vol27/iss3/2

Uzzi, B. (1996). "The Sources and Consequences of Embeddedness for the Economic Performance of Organizations: The Network Effect." American Sociological Review (61): pp. 674-698.

Stevenson, H. H., Muzyka, D. F., et al. (1986) "Venture Capital in a New Era: A Simulation of the Impact of Changes in Investment Pattern." Frontiers of Entrepreneurship Research: 380-413.

OurCrowd. (2021). The Road Already Traveled: Why Invest in Startup Follow On Rounds?. 30/04/2021, from OurCrowd Knowledge Website: https://knowledge.ourcrowd.com/investing-in-follow-on-rounds

West C. & Neelakanti N. (2019). To Follow-on or Not to Follow-on, Part 2 of Un-learnings from a VC-Turned-LP. 30/04/2021, from Kauffman Fellows Website: https://www.kauffmanfellows.org/journal_posts/to-follow-on-or-not-to-follow-on-part-2-of-un-l earnings-from-a-vc-turned-lp

¹ No public information was found on DFJ’s follow-on fund size.

² Staged financing means that a VC agrees to a total investment but invests portions of the total by stages. The VC has the option to abandon the project anytime without a penalty.

³ A relevant VC firm is considered to have north of USD 10 billion in assets under management.

⁴ A relevant VC firm is considered to have north of USD 10 billion in assets under management.

⁵ A relevant VC firm is considered to have north of USD 10 billion in assets under management.